Share This Article

Each month we focus in on one financial topic to help our customers learn more about their personal finances. During the month of July, we’re discussing investing. We’re talking about different types of investing, and how risky each can be. It’s important to do lots of research before deciding what investing works best for you. However, this is a great start to learn about the different types.

Each month we focus in on one financial topic to help our customers learn more about their personal finances. During the month of July, we’re discussing investing. We’re talking about different types of investing, and how risky each can be. It’s important to do lots of research before deciding what investing works best for you. However, this is a great start to learn about the different types.

Below are nine common tools for investing.

Bonds

A bond is an IOU. By buying bonds, the bondholder lends money to a company or a government. In return, the borrower promises to repay the amount borrowed with interest. Corporate bonds are issued by public companies, while municipal bonds are issued by state or local governments. If the business fails, bondholders are paid back before stockholders, so bonds have less risk than stocks. Bonds vary as to risk and return, but in general, bonds offer medium risk.

Certificates of Deposit

Often referred to as CDs, these investments are purchased for a specific amount of money at a fixed rate of interest for a fixed amount of time. CDs may be purchased for as little as seven days or as long as five to ten years. The longer the time, the higher the interest rate. If CDs are cashed in before the specified time, there is a penalty charge. Less liquid than a savings account, but has a higher return than savings. Low risk.

Collectibles

Collectibles could include antiques, art, baseball cards, dolls, stamps, precious metals or gems. The investment is not very liquid because collectibles become more valuable the longer the investor holds onto them, and then the investor must find a buyer. The risk on collectibles is high.

Futures

A futures contract is a deal made today to take place in the future. Futures contracts deal in commodities, which are products such as corn, soybeans, wheat, cattle, gold, crude oil, and foreign currencies. The investor contracts to buy or sell a commodity at a future date, guessing on the value of the commodity on that future date. Investors in futures must be very knowledgeable and willing to take high risk.

Government Obligations

Government Obligations are like bonds – an IOU certifying that you loaned money to the U.S. government. Examples of government obligations include Treasury bonds, bills, notes and savings bonds. The government promises to repay the investor with some return. Even if the U.S. government goes bankrupt, it is obligated to repay bonds.

Mutual Funds

A mutual fund is a professionally managed portfolio made up of stocks, bonds, and other investments. A fund manager buys and sells securities for the fund’s shareholders.

Because a mutual fund includes many different securities, the risk is lower than investing in stocks and bonds that depend on the success of one company or government unit. If some securities in the fund do poorly, others may perform well. In general, mutual funds offer moderate risk and return, although some funds offer higher risk than others.

Real Estate

Buying a home or property is an investment. Over time the real estate may go up in value. Ownership of rental properties and commercial buildings requires time and skill. The investment is not very liquid because the investor must first find a buyer. In general, real estate is considered a moderate risk.

Saving Accounts

Accounts offered by banks, credit unions, and savings and loan associations provide easy access to funds and pay interest. Savings accounts offer the most liquid type of investment, with low risk, and therefore, low interest. If placed in an institution insured by FDIC, money deposited is safe up to $100,000.

Stocks

Stock represents ownership of a corporation. Stockholders (shareholders) own a share of the company and are entitled to a share of the profits as well as a vote in how the company is run. Company profits may be divided among shareholders in the form of dividends, which are usually paid quarterly. If the company does well, the value of the stock should increase over time. However, if the company does poorly, the value of the stock will go down.

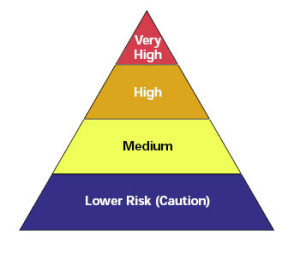

Now that you know a bit more about the types of investing, check out this Risk Pyramid. Can you fill it in correctly based on what you’ve learned?

Come into Young Americans Bank to learn more about investing and pick up additional resources for the Concept of the Month.