Share This Article

It’s important to start conversations about money with children early on in life. Teaching kids the basics — like needs vs. wants and budgeting — can be fun and is an invaluable step in laying a strong financial foundation for future decision making. My financial journey started when I was very young and is a trend I continued with my infant son when we recently opened his first savings account. While he won’t be doing much with that account now, when he gets older it will be a great way for me and my wife to teach him the basics of budgeting and the importance of saving.

A budget will allow children to see how much money they receive and will help them decide on what and how to spend that money. Dividing income into spend, save, and share categories further helps them plan.

I believe one of the best investments a parent can make is in their kids’ financial future and one of the first steps you can take is creating a budget with them. A budget will allow them to see how much money they receive and will help them decide on what and how to spend that money. Divide the budget into three basic categories to help them plan:

- Spend: Most of their money will go into this category and is used to pay for the things they need and want.

- Save: Set aside money to spend in the future.

- Share: Many people enjoy being able to share their hard-earned money with others by donating to charity or spending it on something or someone they care about.

Once your children have their money split up into these categories it’s a good practice — and builds an important habit that will serve them well in adulthood — to revisit and update their budget regularly. Encourage them to consider whether an expense is a need or a want.

Help your children consider whether an expense is a need or a want. It’s never too early to begin talking to your children about money!

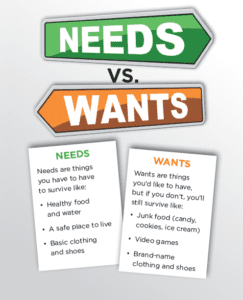

Remember, needs are things they must have to survive like food and shelter. Wants are the things they like having, but can survive without, such as junk food, video games and brand-name clothing and shoes.

For my son, he will be able to start all this early because of our initial investment of opening his savings account. When he’s older, he will be able to use money from his account to buy a birthday present for his mother, to treat himself to a big-ticket item he wants and has saved for, and to donate to a charity whose mission he supports.

Many of these lessons I’ve mentioned are at the foundation of Young Americans’ curriculum, allowing children to learn the basics of money at an early age. I am proud that my company, UMB Bank, supports this organization and recently participated in its “Send-a-School” program — which helped cover the cost for underserved schools to attend Young AmeriTowne. Developing a solid financial foundation at an early age is so important because it helps to set children up for a lifetime of financial stability.

I invite you to use the infographic from this story to educate your children about budgeting as well as their needs vs. wants, and remember it is never too early to begin talking to your children about money!

About the Author

Caleb Hester is vice president of UMB Bank in Colorado. Caleb joined UMB in 2012 and currently serves as a Vice President in their Commercial Banking group. He works with middle market clients across multiple industries to address their financial challenges and helps them develop a plan that ensures long term financial success. Caleb is active in his community and his current and past board involvement includes Tennyson Center for Children, Denver Active 20-30 Children’s Foundation, Denver Children’s Advocacy Center, and Colorado I Have a Dream Foundation. He can be reached at Caleb.Hester@umb.com.