Money management skills can be developed at an early age, and Young Americans Bank is here to help! As a young adult, you can master money management by closely following these financial rules: MoneyMoney spent must never exceed the income available. Save a part of all the money you receive. Put your money to work earning interest. Avoid borrowing because …

The Youth Advisory Board at Young Americans Center for Financial Education provides a valuable youth perspective to the organization while youth gain experience in leadership, business, and philanthropy. Each year, two Co-Chairs lead the Board by planning and running meetings, setting annual goals, and checking in regularly with staff. They also help emcee the annual Spotlight on YouthBiz Stars gala! …

Being a bank that’s just for kids means we take Halloween very seriously around here. Halloween is seriously fun! Young Americans Bank invites you to participate in any or all of the exciting events we have planned: Spirit Week at Young Americans Bank From Thursday, October 24 through Thursday, October 31, Young Americans Bank staff will be wearing their favorite …

When you think about what it means to have a healthy lifestyle, a person’s physical, mental, and emotional health typically comes to mind. At Young Americans Center for Financial Education, we believe that “financial” health is also key to living a healthy lifestyle, a belief supported by long-time partner Lutheran Medical Center. A survey reported by CNBC last February notes, …

AmeriTowne and International Towne began the 2019-20 school year with some exciting changes! The end goal is to provide programs that are relevant, thought-provoking, and that deliver an improved hands-on lesson in financial education. Young AmeriTowne changes include parent communication, curriculum enhancements, and the Day in Towne experience. When a school registers for Young AmeriTowne, teachers receive a Parent Newsletter …

When the Federal Reserve published the latest Report on the Economic Well-Being in May, 2019, results indicated that although saving rates in the United States are improving, there is still much work to be done. In particular, non-white and middle-to-low-income adults reported higher rates of financial distress than surveyed white and middle-to-upper-income adults. Federal Reserve Board Governor Michelle W. Bowman …

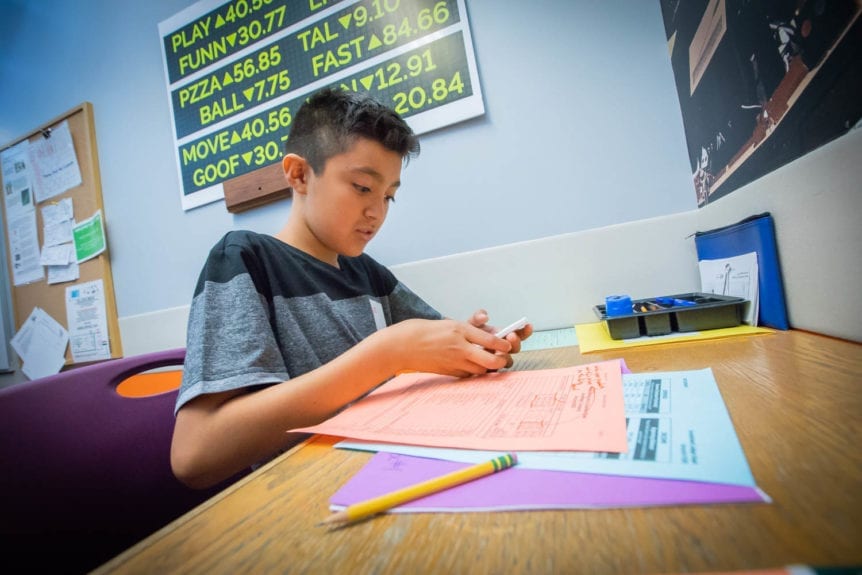

“Tell me and I forget. Teach me and I remember. Involve me and I learn.” – Benjamin Franklin Both anecdotal and research-based evidence suggests that students learn best when they experience a concept for themselves. The Young AmeriTowne and International Towne programs do just that in the field of financial education. They allow elementary and middle school students to open their own …

In Young AmeriTowne, students discover philanthropy by thinking about how they can share their time, talent and treasure. Today, we’re highlighting a proud partner of Young Americans Center for Financial Education that has shared time, talent and treasure with young learners for nearly three decades: Empower. Empower Retirement first became involved with Young Americans Center near the very start of the …

Each year, the Send-a-School Project affords low-income schools an opportunity to participate in the Young AmeriTowne and International Towne educational programs. A valuable partner in this work is CliftonLarsonAllen Foundation, which provided scholarship funds for 504 deserving students last year. Why is this learning so valuable? Researchers are able to demonstrate that financial literacy “reduces the likelihood of being financially fragile …

Every year, the Spotlight on YouthBiz Stars business competition pairs three Denver-area business leaders with three up-and-coming youth entrepreneurs. The first mentor we are highlighting for this year’s 18th annual competition is Ryan Beiser, PNC regional president and head of Corporate Banking for Colorado. Beiser’s extensive background in business and finance and most importantly, his personal commitment to community engagement and …