Take charge of your finances.

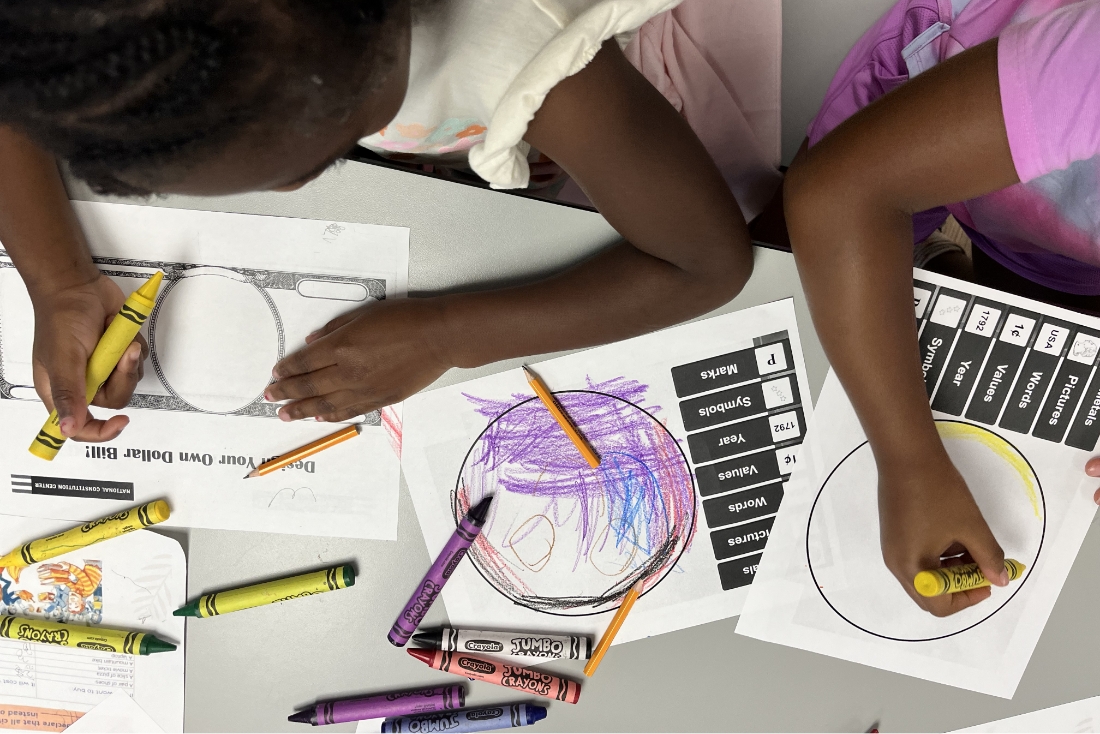

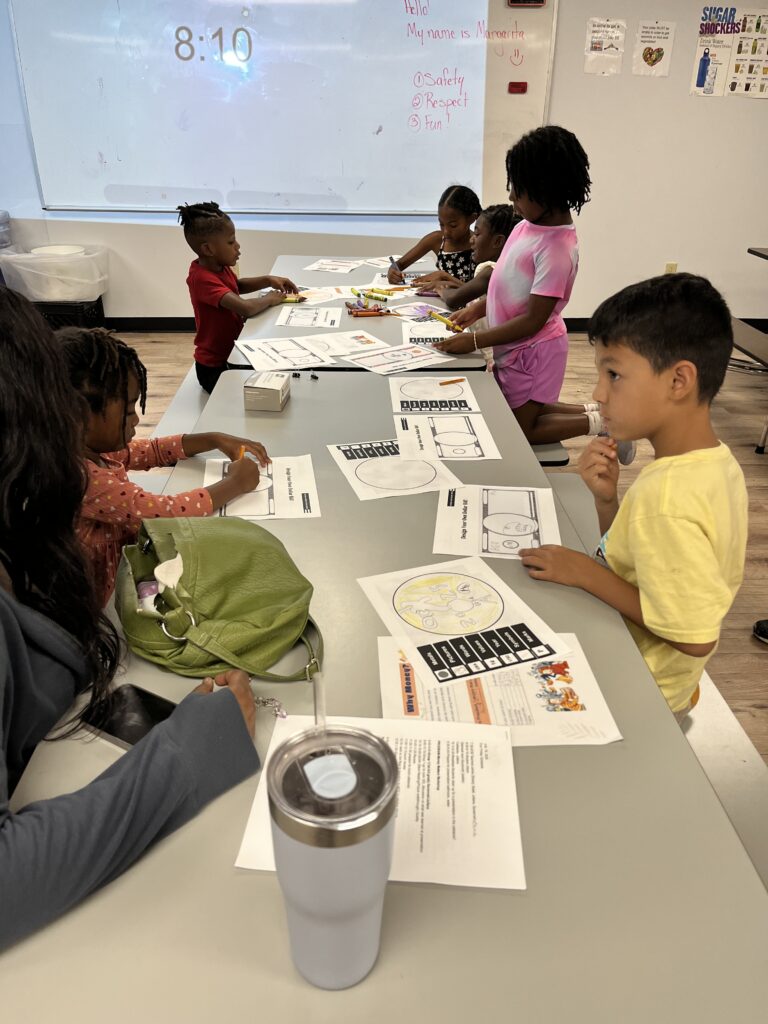

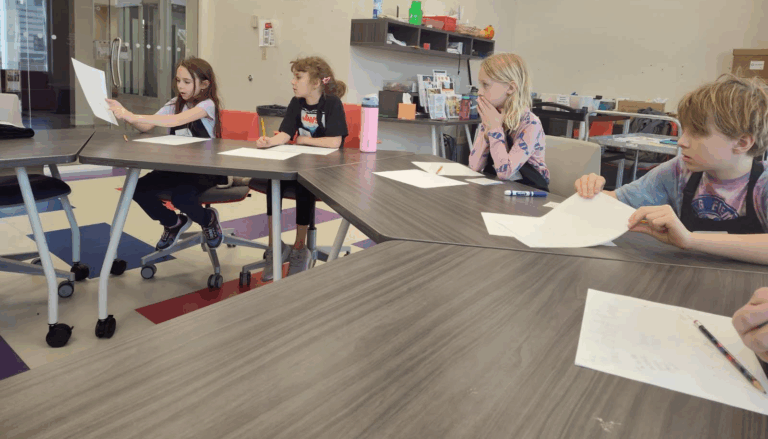

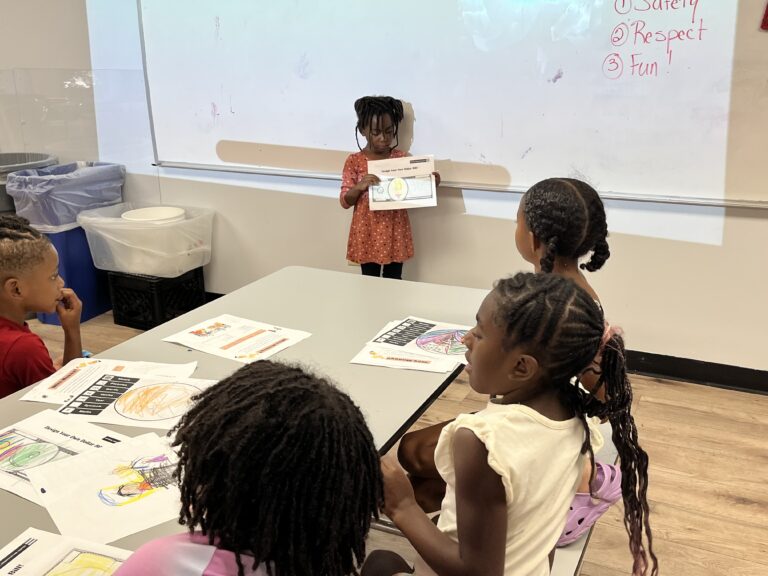

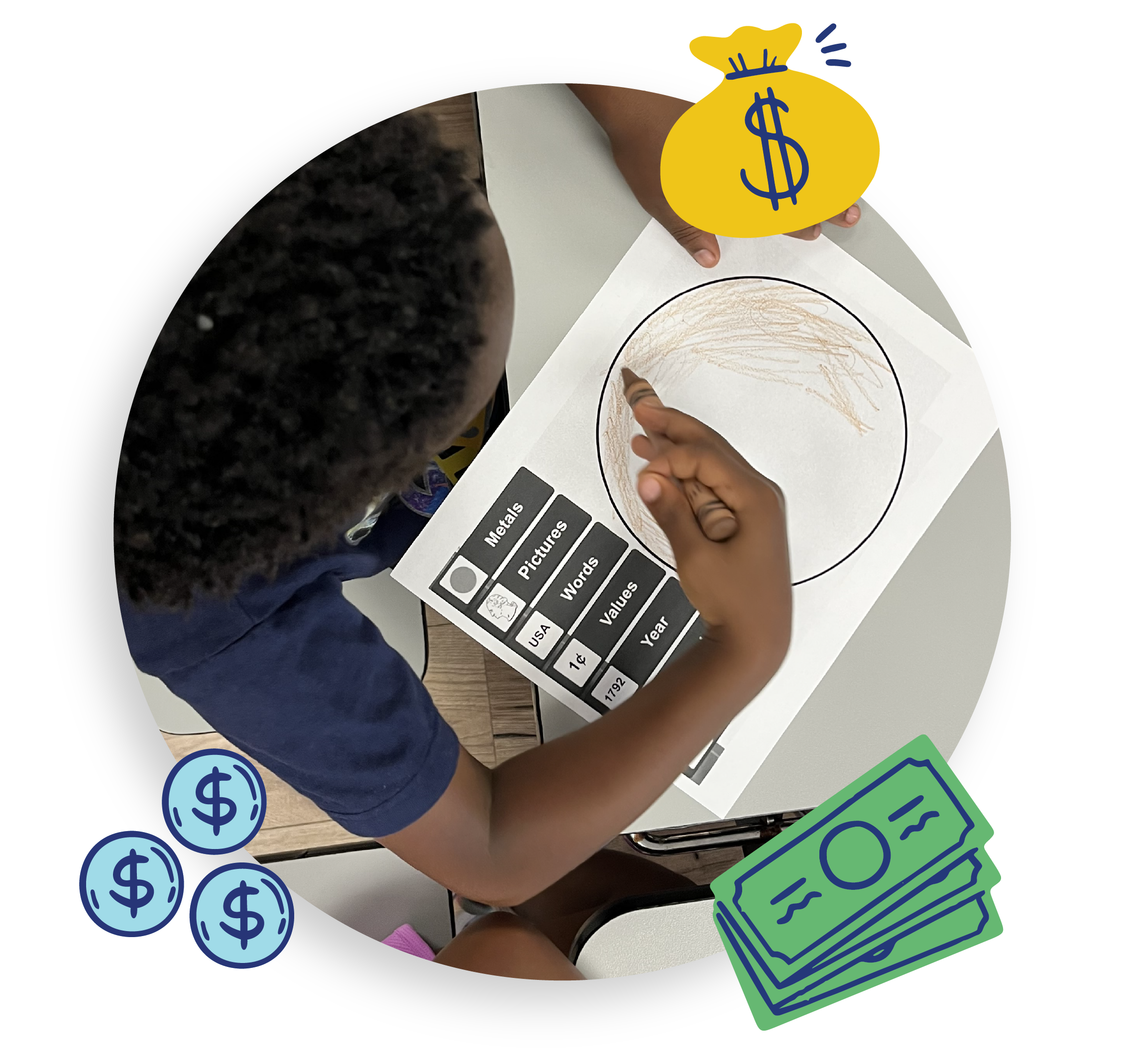

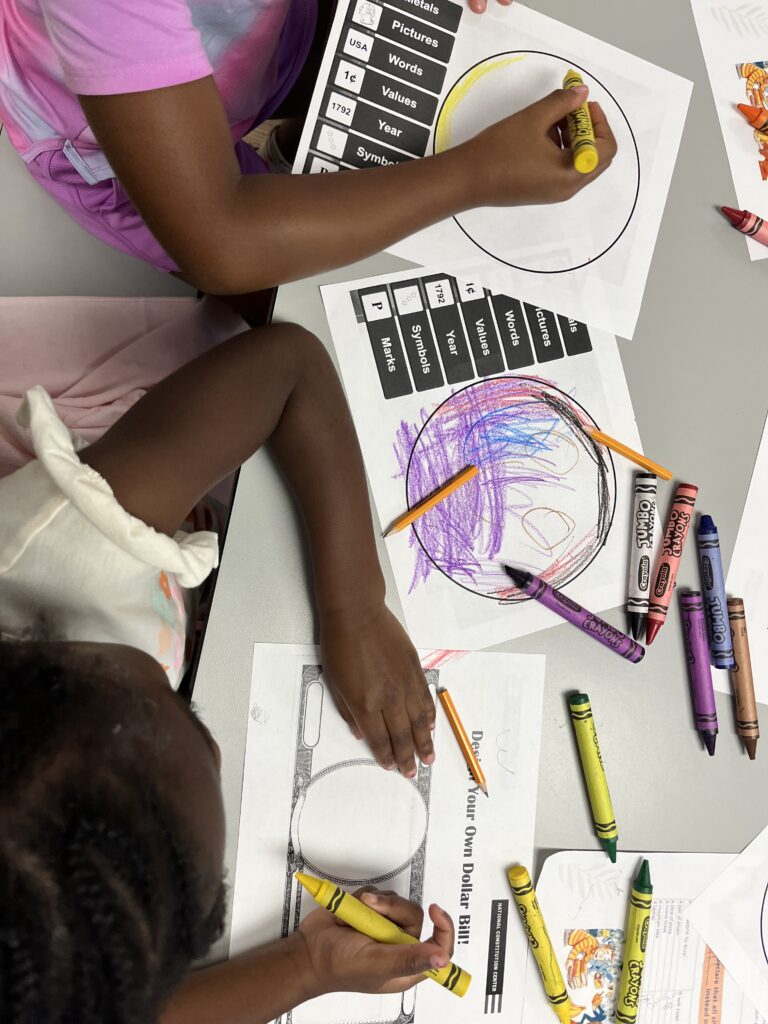

Money Matters® brings personal finance to life for students—both in classrooms and online! Our hands-on workshops and full curricula can be led by our expert staff or taught by teachers using our ready-to-go materials, perfect for groups of 10–30. Plus, our FREE, fast-paced virtual classes let kids dive into fun games and activities while learning the value of money—and in select sessions, they can even earn a $10 savings certificate to start their own bank account!

Which Money Matters® program is right for you?

Financial education for the take charge generation.

Explore more about Money Matters®.

Registration

Registration for Virtual Money Matters is Required.

Technology Needed:

Classes are offered on Google Classroom. Participants will need access to a computer/tablet, an internet connection, a Google account, and the ability to operate Google Classroom by themselves or with the assistance of an adult. Some classes have materials that are available for printing through Google Classroom. Answers can be written on a separate sheet of paper if a printer is not available.

Additional Information:

After registering, participants will receive a Google Classroom password for this class. Please contact Margarita Archilla Kohart at marchillakohart@yacenter.org for questions or assistance registering.

Have questions? Contact us for help in choosing the perfect program for your students.

Register your student for virtual Money Matters®.

Register Here

Learn how you can support Young Americans.

Get involvedThe free enterprise system is the 8th wonder of the world. Teaching young people to be active participants is our responsibility for its preservation.

”Frequently Asked Questions

How can I get Money Matters to my school?

Contact Margarita Archilla Kohart to get started: marchillakohart@yacenter.org or (303) 320-3242.

How long does it take to teach the curriculum?

- K-3 takes approximately 12 instructional hours.

- 4-8 and 9-12 take approximately 14 instructional hours.

How much does it cost to attend and are there scholarships?

Cost varies based on the following considerations: Single Workshop vs. Full Curriculum, Teacher-Facilitated vs. YA Staff Facilitated, and Onsite vs. Offsite Delivery.

Financial aid is available. Contact Margarita Archilla Kohart for more information: marchillakohart@yacenter.org or (303) 320-3242.