This month, Young Americans Bank wants to help you better manage your money! One of the most important personal money management rules is to live within your income. To accomplish this, most of us need a plan for how we will spend our money. Here are 5 steps you can use to create a spending plan: Step 1 – Take a …

Do you want to be a millionaire? Then start now! SAVE your money, get a summer job, invent something the world can’t live without, or start your own business! To help you get on your way, this month Young Americans Bank brings you seven savvy summer job ideas: Cleaning Services: Washing windows, washing and waxing cars and boats, cleaning pools, cleaning aquariums, …

Pay Yourself First What does Pay Yourself First Mean? Pay Yourself First means that any time you receive money, you should immediately set aside an amount to save. Why Pay Yourself First? Once you deposit money into your savings account it is safer, and you’re less likely to spend it than if you keep it with you. When you save …

Making a budget can be hard. But, when you make a practical budget and stick to it, you’ll find you have all the money you need for the important things you really want and need! Other reasons to budget include: When you make a budget and stick to it, you are less likely to squander your money on impulse purchases …

Do you want something but don’t have enough money? Using this worksheet, you can set a savings goal, figure out how much you can save each week or month, and find out how long it will take you to get to that goal. Why should you have a savings goal? Read on… If you don’t set a goal, chances are …

This month, Young Americans Bank introduces you to nine common tools people use for investing. What is investing? You can think of it as spending money to make money. The goal of investing is to buy something now that will be worth more in the future! When you invest money, you are taking a risk. Sometimes an investment makes money, …

It is very important to keep track of your own transactions in your checkbook register, and then double check your register with the statement the bank sends you every month. Make sure all the checks and deposits that the bank is showing are correct, and that you haven’t missed recording any of those same deposits, checks, or withdrawals in your register. What’s the …

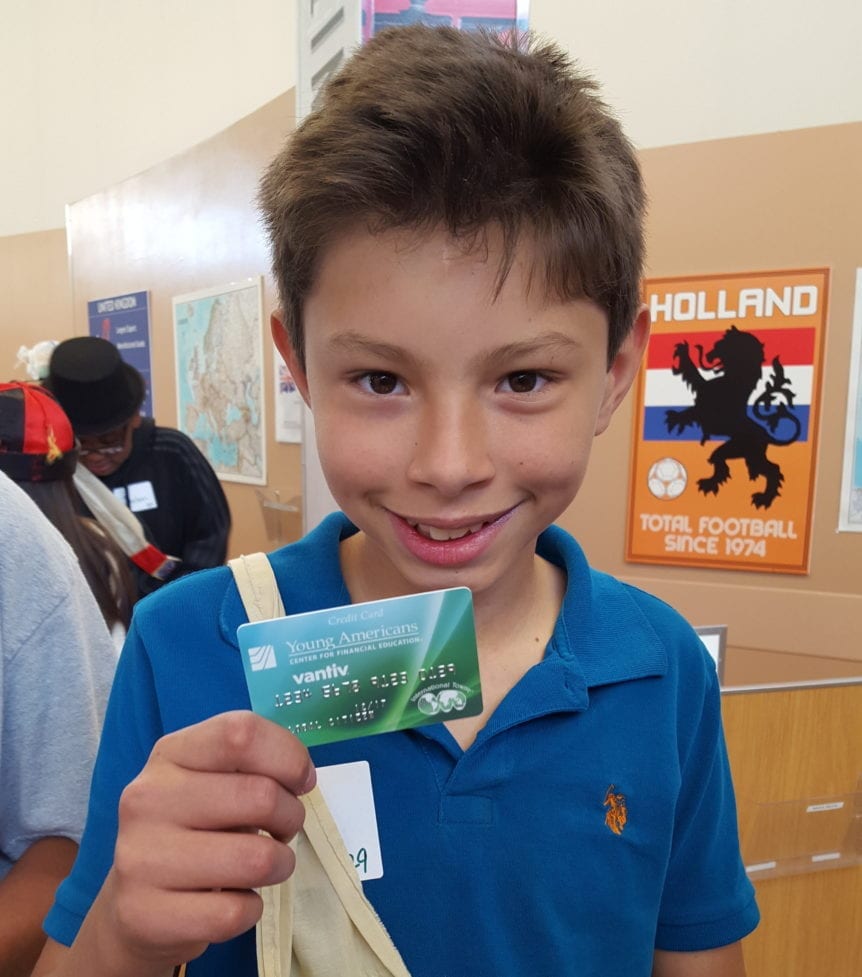

Young Americans Center for Financial Education is thrilled to announce the grand opening of a third branch of Young Americans Bank located in Lakewood. Specifically designed for youth up to age 22, Young Americans Bank provides hands-on education in finance while offering products and services customized for young people. This third branch, which joins existing locations in Cherry Creek and …

U.S. News & World Report, a nationally recognized publisher of consumer advice and information, recently completed a nationwide financial literacy survey in order to get a comprehensive understanding about consumers’ experiences with credit cards. The results of the study reveal that many consumers don’t understand the basics of credit card ownership, such as credit score, interest rate and the consequences …

The holidays are quickly approaching which means you will likely be doing some spending! Whether you’re buying gifts for friends and family or thinking about what to buy with your own holiday gift cards or cash, Young Americans Bank has some tips to help you spend smarter. Budget Set a spending limit for yourself and stick to it. When you’re …