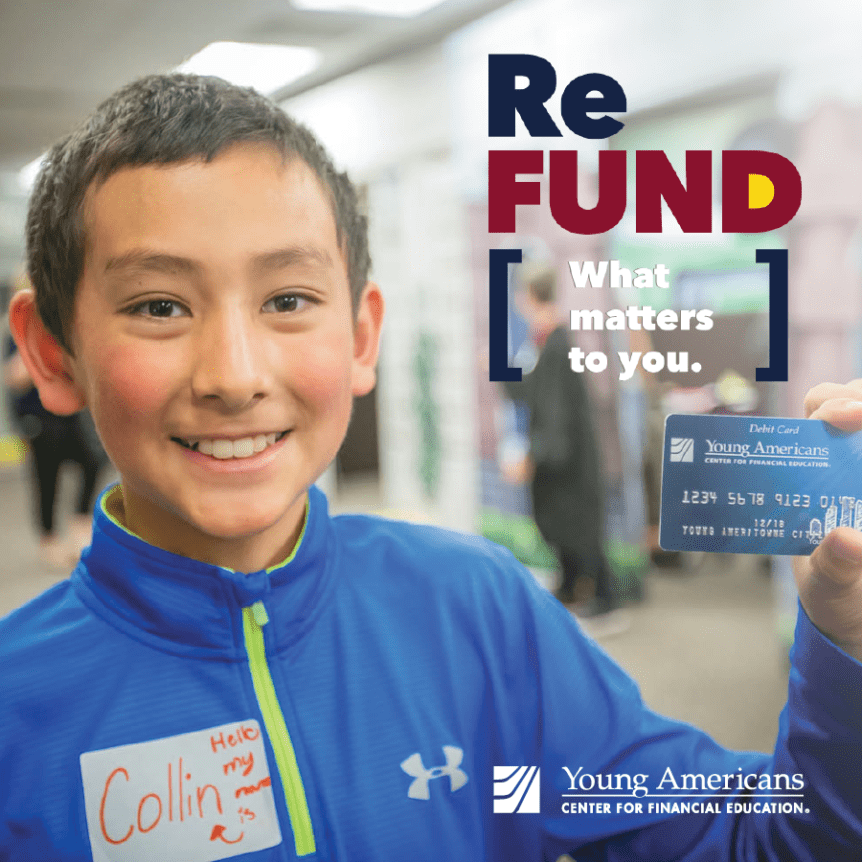

Donate your tax refund to Young Americans Center for Financial Education

Contribute to Young Americans Center for Financial Education through your Colorado tax return

Young Americans Center for Financial Education is proud to be one of the registered nonprofits participating in Colorado’s “Donate Your Tax Refund to Charity” program, an important fundraising program offered through the Department of Revenue.

This statewide program allows taxpayers to make contributions to their favorite charitable organizations when they file their state income tax return.

You can easily donate to Young Americans Center for Financial Education Fund (on line 17) as you are doing your tax returns and help us meet our goal of raising $50,000 for financial literacy programs benefiting 47,400 students every year across the state.

Remember, you can make a donation even if you take the standard deduction.

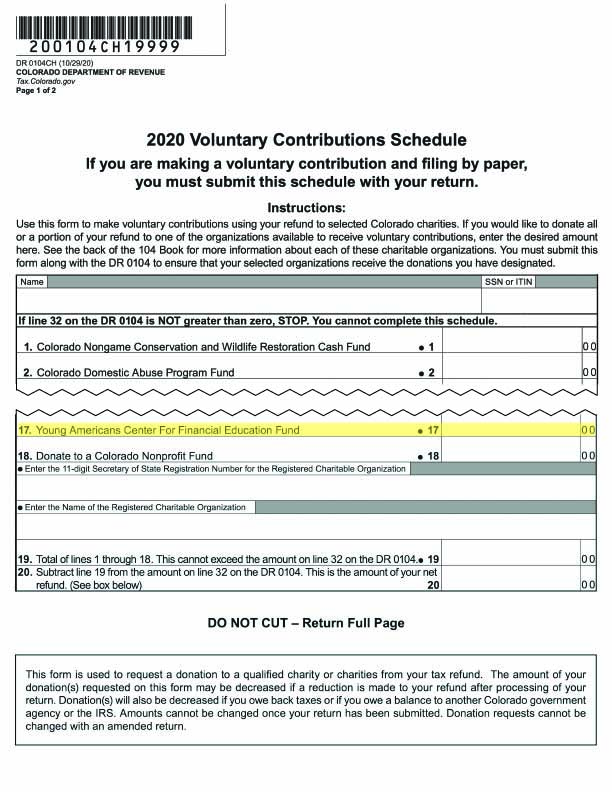

Steps to make a gift from your Colorado Tax Form:

1. As you complete your Colorado Individual Income Tax Form

2. Select Young Americans Center for Financial Education Fund on line 17 of Form DR 104CH.

3. You’re done! If you use a tax preparer, simply remind them you’d like a portion of your refund to go to Young Americans Center for Financial Education on form 104CH.