Share This Article

Have you ever wondered what your 5th or 6th grader might do when they get a job and start paying for all the necessities in life? Look no further than the Money$ense Saturday event we hosted on April 19th. Though the group in attendance was small, the lessons learned were mighty, if not permanent.

Luck of the draw

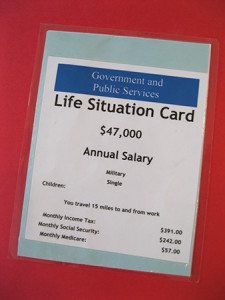

The day started with a little luck. Students chose jobs like lawyer, zoo keeper, or military personnel. Then they got a dose of real life, courtesy of chance cards. Some of the kids had good luck and received a financial windfall. Others, however, chipped a tooth or got into a car accident and were responsible for paying their bills.

After everyone received a job and a chance card, we created a budget based on recommendations from the National Endowment for

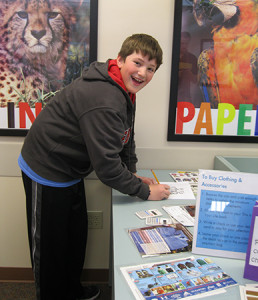

Financial Education. The students and staff had a great time picking jobs and creating their budgets, but the bulk of the learning happened during the simulation when the kids went shopping for the things they needed: housing, utilities, groceries, transportation, and health insurance. When their needs were satisfied, they were able to purchase things they wanted: clothing, entertainment, and cable.

Make it all add up

While shopping, some kids wanted to save as much money as possible in transportation so they could have money for video games. They decided to walk to and from work, which would have been great if they didn’t have to travel 13 miles each way. Another student was determined to buy a mansion (the one with 9 bedrooms and an indoor pool), but quickly realized he couldn’t afford it based on his $78,000 annual salary. These discoveries allowed our staff to have candid conversations with the kids about how their decisions would affect their daily lives.

Of course, the students were challenged to keep track of their spending and to “live within their means” during the purchasing experience. Most of them did very well with making wise choices and sticking to their budgets during the simulation. However, when it came time to balance the budgets at the end of the activity, they quickly realized that adding all those expenditures was quite difficult. In fact, there was only one participant able to accurately balance his budget!

The takeaway

Regardless of whether or not the kids were able to succeed in our budgeting challenges, they walked away with new-found wisdom. Check out some quotes from our exit survey below.

What was the most difficult thing you did today?

“Meet my [Net Monthly Income]”

“The actual budget”

“Keeping track of money”

Did any of our lessons/activities surprise you?

“Yes. The lesson on mortgage”

“Yes. I think the house buying was expensive.”

“Yes. It was hard.”

Would you recommend this simulation to a friend?

“Yes. It was very fun.”

“Yes. It was very fun and helpful.”

“Yes. It was cool.”