Share This Article

Young Americans’ popular Summer Camps fill up fast and savvy parents know to get their children (grades 2 – 7) registered quickly for the $240 one-week Fun-nancial adventures. But what if $240 is too much for a budget strapped family? That’s where you come in. Last year, donors gave scholarships to 46 children from low-income families.

Young Americans’ popular Summer Camps fill up fast and savvy parents know to get their children (grades 2 – 7) registered quickly for the $240 one-week Fun-nancial adventures. But what if $240 is too much for a budget strapped family? That’s where you come in. Last year, donors gave scholarships to 46 children from low-income families.

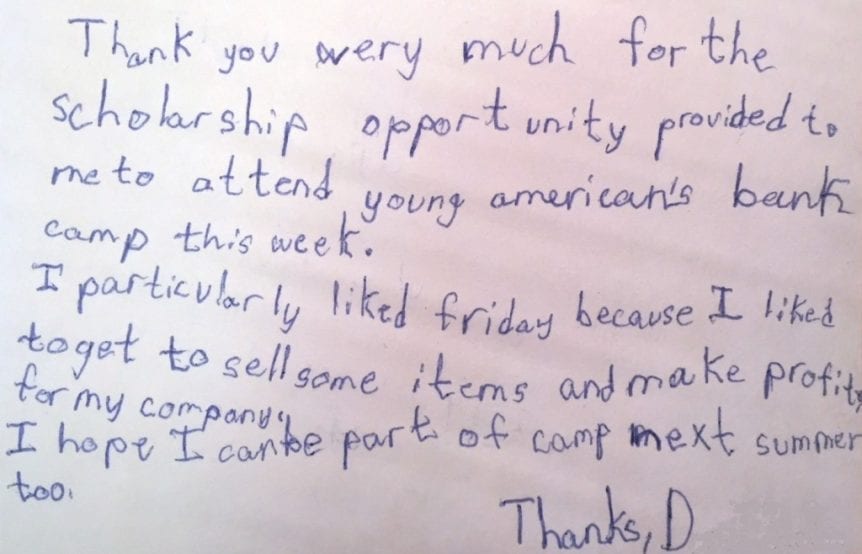

Reason #1 to join this group that believes all children should have the financial skills for success. You’re a hero to a very excited child:

Reason #2 is you’re a hero to a very grateful parent who writes:

“We are so thankful to the donors that helped (our child) attend Young Americans Summer Camps. It could not have been accomplished without their generosity.”

Reason #3: the State of Colorado will give you a Child Care tax credit (gifts of $250+).* Actual money back when you file your 2018 tax return that you can put towards making a bigger impact for children. And it’s significant: 50% of your gift. Just use the note field to tell us your gift is for Summer Programs and Young Americans will send you the paperwork for your tax preparer. We ask for gifts of $250 or more to qualify for the Child Care Tax Credit, but gifts in any amount help give this opportunity to a low-income student.

Reason #3: the State of Colorado will give you a Child Care tax credit (gifts of $250+).* Actual money back when you file your 2018 tax return that you can put towards making a bigger impact for children. And it’s significant: 50% of your gift. Just use the note field to tell us your gift is for Summer Programs and Young Americans will send you the paperwork for your tax preparer. We ask for gifts of $250 or more to qualify for the Child Care Tax Credit, but gifts in any amount help give this opportunity to a low-income student.

*Disclaimer: Young Americans has registered this program with the State of Colorado and therefore donations qualify for the Colorado Child Care Contribution. Please consult your tax advisor before planning to take the Child Care Tax Credit.