Share This Article

When the Federal Reserve published the latest Report on the Economic Well-Being in May, 2019, results indicated that although saving rates in the United States are improving, there is still much work to be done. In particular, non-white and middle-to-low-income adults reported higher rates of financial distress than surveyed white and middle-to-upper-income adults. Federal Reserve Board Governor Michelle W. Bowman summarized the findings this way: “Across the country, many families continue to experience financial distress and struggle to save for retirement and unexpected expenses.”

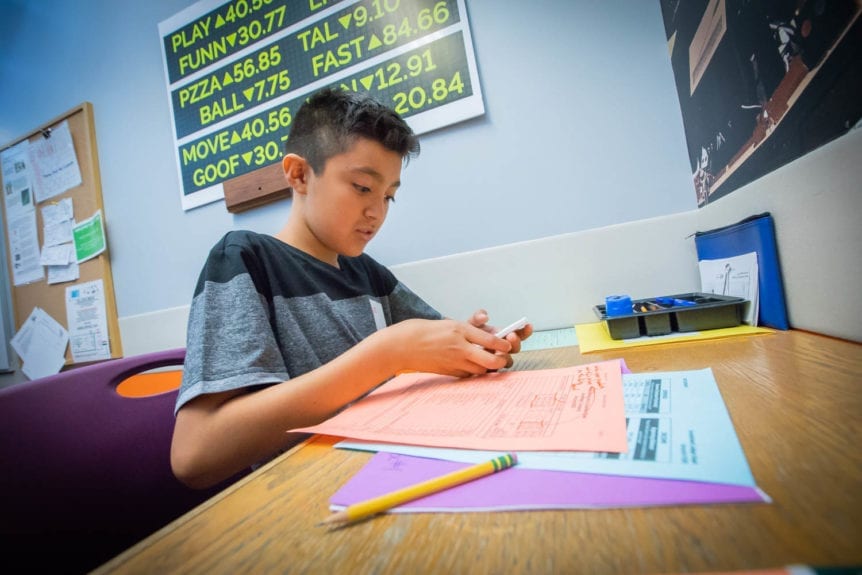

A Young AmeriTowne citizen records a purchase in her checkbook register which helps her track her spending.

Why is saving important? Having an emergency savings fund can mean the difference between disaster and financial disaster when your car breaks down or when a water pipe breaks. According to the Federal Reserve report, four in ten Americans couldn’t cover a $400 emergency expense without going into debt or selling something to cover the expense.

If saving is so important, yet it’s difficult for people to save money, how do we help people learn how to save? Young Americans Center for Financial Education believes that this lesson is best taught at a young age. Exposure to topics such as savings, retirement, and interest allow young people time to practice and develop good habits.

In the Young AmeriTowne program, for example, students deposit money into their saving account to “pay themselves first”—this money isn’t available for use while they participate in the actual Day of Towne experience. Ten-year-old Ecco visited AmeriTowne with his classmates from Arrowhead Elementary, and this lesson came to life. “I learned that you don’t have unlimited money and you have to spend it carefully,” he wrote. Kellan, who attended a few weeks later with Field Elementary, also benefitted. He wrote, “banking is important because it helps you keep your money safe and save.”

Thanks to proud community partners like Vectra Bank Colorado, these lessons reach all youth. Vectra Bank supports the Send-a-School initiative which provided scholarships for 8,271 deserving youth in 2018. According to Heather White, Community Banking Director and Executive Vice President of Vectra Bank, “Vectra Bank Colorado is proud to support the Send-a-School initiative at Young Americans Center because providing all students, regardless of background, with foundational financial knowledge will create healthy, thriving communities throughout our state for years to come.”