Share This Article

The following post is written by the father of two account holders at Young Americans Bank. The family recently undertook an interesting financial exercise that could be great for other families to try!

The following post is written by the father of two account holders at Young Americans Bank. The family recently undertook an interesting financial exercise that could be great for other families to try!

A unique budgeting exercise

This Spring we tried a new tactic at home to engage our children with family budgeting. At our house we have two kids still in the home, Lucy, age 6 and Tucker, age 11. Both kids are good at saving money and good at earning money through chores and entrepreneurial activities but both kids still have a lot to learn about budgeting and spending, so here’s what we did.

We took 8.5 x 11 sheets of paper and wrote a topic on each of them:

Living, Future, Mommy, Daddy, Lucy, Tucker

We hung these topics on the wall in our living room.

Next we gave the kids 3 x 5 note cards and asked them to write on each one something that was important to them that costs money. My wife and I did the same.

We wrote things like: Soccer, Swimming, Karate, Vacation, College, Softball, Boy Scouts, Yoga, Eating Out, Dance Class, Music Lessons, Expanded Cable, Netflix, Gamestop, Movies, Golf, House, Cars, Utilities, Paying off Debt, Savings, etc… We tried to create a card for everything we spent money on. Here’s one example:

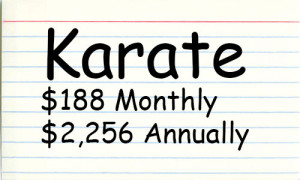

After we wrote down everything we could think of, we then added the monthly cost and the annual cost for each item:

Once all of the cards were done, we put some of them beneath the Living and Future 8.5 x 11 topics so that the kids could see how we prioritized things like House, Cars, Utilities, College, and Saving.

Understanding the costs

We talked about the previous year. Our family had been very busy with activities for two children and the costs and time commitments had not been managed. For the most part this was a learning experience for all of us since until then we only had one child in activities and all of the new experiences we were providing for Lucy took us by surprise.

Then the epiphany happened!

After explaining the importance of planning and management, we asked the kids to pick three items from their deck of cards and place them under their names. We encouraged them to pick the three most important things to them. We told them the things they chose now are the things that the family would support them with until next spring when we did the planning again.

They placed their three items underneath their names.

Tucker choose: Soccer $180, Boy Scouts $1,200, Swimming $80

Lucy chose: Karate $2,256, Dance Lessons $750, Softball $400

Then something unexpected happened. When the children were done choosing three things, they created a pile of discarded cards. Both kids reflected on their choices, made more changes, and finally committed to their final decisions.

Once done, Lucy asked this question, “Can I take something from Tucker’s discard pile and use it as one of my three things?” The answer was yes. This gave us even more insight into how we were investing in the kids.

Great insight

It was amazing to learn what was really important to our kids. My wife and I were able to immediately see the difference between the activities we wanted for the kids versus the activities the kids loved to do.

Note: This meant that they gave up other costs for this year. We were able to trim things like Netfilx, expanded cable movie channels, and Gamestop subscriptions.

Once we completed the exercise, we shared our income with the kids and deducted all of the costs from our income so that the children could see how all of our money is spent and saved.

The results were that we trimmed several hundred dollars from our monthly budget while inspiring a sense of ownership in both children related to the activities they chose.

Finally, the children asked if they could use their allowance to pay for some of the other cards that they discarded and we said “of course.” The two went back through the piles and picked out some things they could afford on their own. Both of them chose an expanded cable box at $9.99 a month so they could have the value of Netflix while getting DVR capabilities.

Overall we were able to engage the kids with the concepts of financial planning, budgeting and saving while inspiring them to commit to the things they love to do.

Thank you, Dennis, for sharing this fascinating exercise! Tell us below if your family has done anything similar, or if you plan to try this with your family.