“Nearly a third of young adults in a recent study were found to be “financially precarious” because they had poor financial literacy and lacked money management skills and income stability.” – ScienceDaily, citing a study by researchers at University of Illinois at Urbana-Champaign The individuals in this study will likely face a lifetime of financial hardship. The results of the …

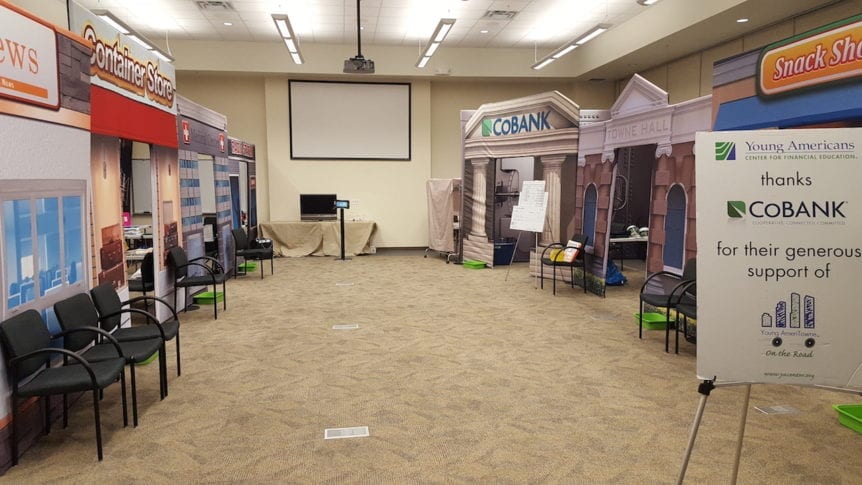

On a recent day in Young AmeriTowne, 10-year-old Ricardo* was having the time of his life. You couldn’t walk past the Market without hearing him call out to customers, and he had a huge smile on his face as he helped customers pay for their products at the cash register. Ricardo and his fellow classmates participated in this beloved program …

Nearly 11,000 young people experience International Towne, a hands-on lesson in global economics, every year. This number includes more than 1,800 students who participate as part of the Send-a-School scholarship initiative, funded in part by proud supporter U.S. Bank Foundation. What makes this learning so powerful, particularly for low-income students, is that the lessons they are learning will help them in …

Young Americans greatly benefits from the dedicated leaders on our three Boards of Directors overseeing Young Americans Bank and Young Americans Center for Financial Education. Today we’d like to introduce you to long-time board member Charles (Charlie) D. Maguire, Jr., Partner at Bryan Cave Leighton Paisner LLP. At Bryan Cave Leighton Paisner LLP, Charlie represents a wide range of companies in …

Do you know the difference between a debit and a credit card? A surprising number of young adults don’t. According to a 2016 study done by LendEdu, 43% of college students couldn’t explain at least one difference between a debit and credit card. Although the survey was small, only 455 students, that’s still a high number. Thanks to Worldpay, formerly …

Young Americans Center for Financial Education exists to provide every Colorado student, regardless of background, with the opportunity for effective training in financial literacy and workforce skills. Why is this so important? Research suggests that a basic introduction to financial concepts—saving, credit, banking, and investing—at a young age helps prepare students to be financially responsible adults. This knowledge is particularly beneficial …

What is the value of financial education? Most people agree that better knowledge about financial concepts is a good thing, but what is the actual cost of the alternative? While actual numbers vary, all reports are disconcerting. The National Financial Educators Council reports that in 2017, the average family lost $1,170.95 due to lack of financial knowledge. Howard Gold, a …

It’s Summer Camp Week on Fox 31’s Colorado’s Best, and Young Americans kicked it off by showcasing this summer’s week-long day camps. Designed for youth who have completed second through eighth grade, Young Americans Summer Camps offer fun, hands-on experiences in financial literacy! Young people can build a business in entrepreneur camps such as Running Your Own Biz or Be …

It feels like the first day of the 2017-2018 AmeriTowne year was just last week, so how can it be February already?! The year is flying by, which means that in no time at all, summer will be here! Young Americans Center is already gearing up for summer camps and registration has opened up online. There are so many camps …

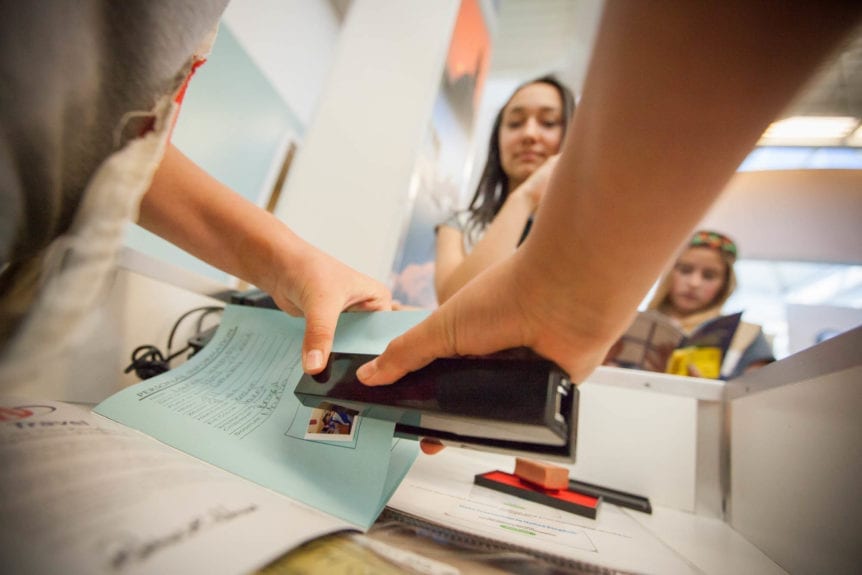

Young Americans Center’s International Towne program provides a hands-on experience in global economics, and so much more! Every year, nearly 11,000 middle school students get a taste of world travel in just one day. A proud partner in this work is AAA Colorado, which presents each student with a passport for traveling throughout International Towne. An objective of International Towne …