Share This Article

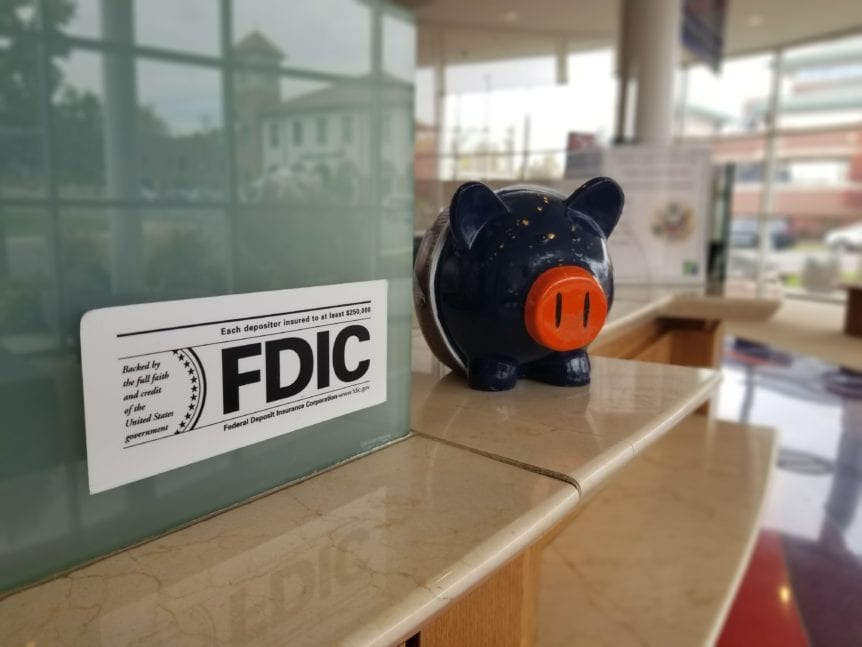

It’s hard to step foot inside a bank without seeing the letters FDIC. And that’s for a good reason! The FDIC, or Federal Deposit Insurance Corporation, is an independent agency created to keep customer money safe. Today’s blog will explore how the FCID came to be and why consumers can trust banks that are members of the FDIC.

In the 1930s, the United States economy was in bad shape. Millions of people had lost their jobs, and more than 9,000 banks had failed. That meant the people who needed money and who kept their money in a bank couldn’t access their funds, despite the fact that they had put their money in a bank to keep it safe.

As a result, Congress passed and President Franklin Roosevelt signed the Banking Act of 1933. This legislation established the FDIC and provided other reforms to the banking system to help protect consumer money. The FDIC guaranteed a certain amount of money for savings and checking accounts for all member banks. Essentially, if a bank failed, a customer was still entitled to those funds and arrangements were provided by the FDIC if necessary.

This protection still exists today. Savings and checking accounts are insured up to $250,000, as long as the bank is a member of the FDIC. If a bank fails, the customer’s funds are transferred to a new bank where the customer may withdraw the funds or continue to use the new account. The FDIC also examines and supervises financial institutions to ensure they are safe places to hold money.

Before choosing a bank, consumers should ensure the institution is a member of the FDIC. Young Americans Bank is, and so are more than 5,000 banks across the country. For more information, visit the FDIC online.